However, this version is rarely applied in practice, partly because of disagreement over the debt repayments (whether only mandatory or also voluntary repayments should be included) and also due to the need for a debt schedule.Īs a next step, you must calculate the discount rate that you will use to get the present value of the cash flows. Levered FCF gives a slightly better estimate of how much cash flow is available to just the equity investors. (+/–) Change in Working Capital from CFSĪs you can see, the Levered FCF is similar to the Unlevered version, but it also reflects interest (and the corresponding tax shield) and debt repayments.(+) Recurring Non-Cash Adjustments (such as Depreciation & Amortization, Deferred Income Taxes, etc.).

Depending on which investor group you are targeting, you can either use Unlevered FCF (also known as FCF to the Firm) or Levered FCF (also known as FCF to Equity), where the formulas are as follows:

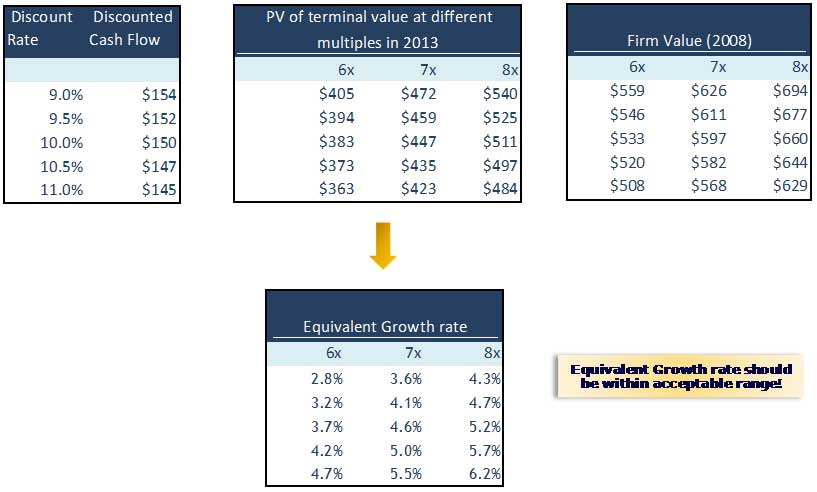

#Implied perpetuity growth rate of cashflows free

Usually DCF is helpful when your company is in a mature stage and has stable, predictable cash flows.įirstly, you project the company’s Free Cash Flow (FCF) in the near term (next 5 to 10 years).

In a DCF model you are valuing a company based on its cash flows (“intrinsic” valuation).The model includes several assumptions based on your own view of the company.

0 kommentar(er)

0 kommentar(er)